Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Applying WILL NOT impact your credit.

Explore financing for construction businesses—from SBA loans to equipment funding and more.

Applying WILL NOT impact your credit to review your options*

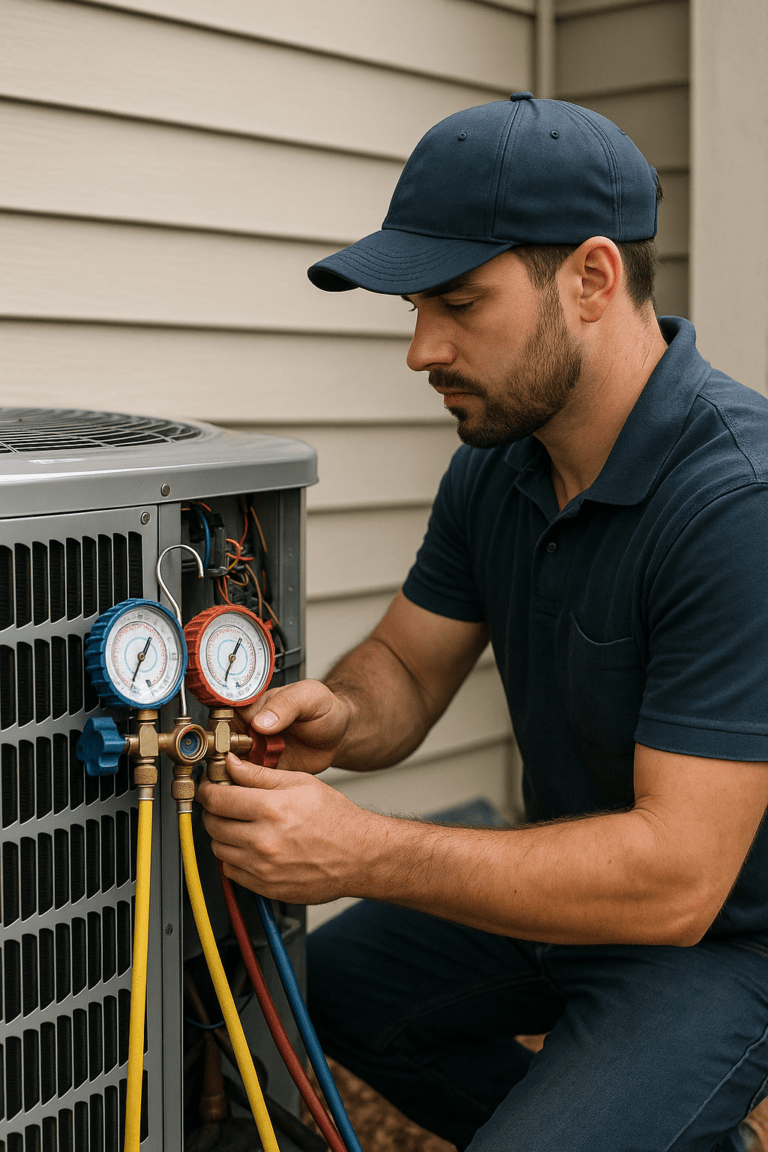

Construction companies face unique financial challenges—delayed payments, high equipment costs, and cash-hungry projects. That’s why construction business loans are designed to help contractors, builders, and general construction companies maintain stability and seize growth opportunities

Pros: Low interest rates, long repayment terms

Cons: Slower funding, paperwork-intensive

Use Case: Large expansions, refinancing, buying property

Pros: Easier approval, fast funding

Cons: Limited to equipment purchases

Use Case: Buy or lease excavators, skid steers, loaders

Pros: Flexible access to funds

Cons: Can be expensive if used irresponsibly

Use Case: Payroll, emergency cash, seasonal gaps

Pros: Fast approval, minimal documentation

Cons: Higher interest rates, short terms

Use Case: Bridging gaps before payments hit

Pros: Turns unpaid invoices into working capital

Cons: Affects client communication, fees add up

Use Case: Government or commercial jobs with net-60 terms

| Loan Type | Pros | Cons |

|---|---|---|

| SBA Loans | Low interest, long terms | Slow funding, requires strong credit |

| Equipment Financing | Fast approval, no cash upfront needed | Only for equipment |

| Line of Credit | Use only what you need, reuse as paid | Easy to misuse, variable rates |

| Short-Term Loans | Very fast, great for shortfalls | Higher interest, quick repayment |

| Invoice Factoring | No debt, improves cash flow | High fees, client perception |

Start by filling out AMP Advance’s secure online loan application. It only takes a few minutes and requires basic info about your construction business, including revenue, time in business, and loan amount needed.

Upload your most recent 3–6 months of business bank statements. These help AMP Advance understand your cash flow and match you with the best contractor financing options or working capital solutions.

Within hours, you’ll receive a custom business loan offer tailored to your company’s financials—whether you need an equipment loan, short-term funding, or a line of credit.

Once approved, you’ll receive funding in as little as 24–48 hours, directly to your business bank account. Use your loan to purchase materials, hire labor, or take on larger construction projects.

Posted onTrustindex verifies that the original source of the review is Google. AMP helped me secure a business line of credit that was a game-changer for my seasonal tourism business. During the slow months, it gave me the cash flow I needed to cover payroll and prep for peak season—smooth, fast, and exactly what I needed to stay afloat.Posted onTrustindex verifies that the original source of the review is Google. John at AMP got creative and made it happen. He stacked multiple funding options to get me the capital I needed fast. Smart, responsive, and results-driven. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. John and his team(AMP Advance) are very professional and knowledgeable. Im a restuarant owner in California, having access to quick capital is crucial to us restaurant owners That's what Amp Advance has been able to do for us. Quick turn around, competive pricing, not to mention their customer service is second to none. I would highly recommend giving John and his team an opportunity to earn your business. Thanks Amp Adavnce,Posted onTrustindex verifies that the original source of the review is Google. Amp Advance did great with their customer service, understanding my business, and quick loan services. Thanks a lot for the help with my Florida Business Loan.Posted onTrustindex verifies that the original source of the review is Google. Glad I called AMP, they came in clutch for business funding for my Irvine, CA business when my biggest client had payment issue to help me cover my payroll with a business line of credit.Posted onTrustindex verifies that the original source of the review is Google. You've guys helped me hit my funding goals so I can grow my business from start up to where I am today! Your team took the time and helped me a lot. Thanks!Posted onTrustindex verifies that the original source of the review is Google. I used AMP to secure equipment financing for network servers and storage networks. The process was smooth, and they helped me get exactly what I needed, without tying up my cash flow.Posted onTrustindex verifies that the original source of the review is Google. Carlos got me funded for a business line of credit where my bank declined me! He’s my guy when I need business funding I would highly recommendPosted onTrustindex verifies that the original source of the review is Google. Matt and the team at AMP helped me consolidate my business debt into a single loan with an affordable payment, saving me 40% on cash flow.Posted onTrustindex verifies that the original source of the review is Google. John and the team at AMP were absolute lifesavers! They listened to my needs and made the process of securing a business line of credit easy and educational!Google rating score: 5.0 of 5, based on 46 reviews

Yes, it’s possible to get a construction business loan with bad credit, especially through alternative lenders like AMP Advance. Options like equipment financing, invoice factoring, and short-term working capital loans are more flexible and may not rely heavily on your credit score. Instead, lenders may consider your business revenue, time in operation, and cash flow.

Yes, many construction companies qualify for SBA loans, especially if they meet the SBA’s requirements for revenue, time in business, and credit. SBA 7(a) and SBA Express loans are common choices for contractors looking to secure long-term, low-interest financing for growth, payroll, or equipment.

The best loan for buying construction equipment is typically equipment financing, which allows builders and contractors to purchase heavy machinery without paying upfront. The equipment itself often serves as collateral, making it easier to qualify—even with less-than-perfect credit.

Absolutely. Many working capital loans for construction businesses are used to cover labor costs, including paying subcontractors and temporary crews. This helps keep projects moving even when invoice payments are delayed.

Getting pre-qualified for a contractor loan online through AMP Advance is fast and simple. Fill out a short application, upload your business bank statements, and receive loan options within hours—no hard credit check required to view your offers.

Our minimum qualifications require:

SBA Business Acquisition Loan: Seize Opportunities in the Silver Tsunami...

Read MoreAddress

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306