Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Understanding your DSCR (Debt Service Coverage Ratio) is one of the smartest steps you can take before applying for financing. Whether you’re expanding operations or purchasing equipment, knowing your cash flow coverage helps you plan ahead and meet lender expectations. If you’re exploring options like an SBA 7a, a strong DSCR can be the key to unlocking better rates and terms.

Lenders use DSCR to judge your repayment strength.

SBA 7(a) lenders typically look for a DSCR between 1.15× and 1.25×.

A higher DSCR improves approval odds and loan terms.

You can increase DSCR by boosting cash flow or reducing debt.

Use the DSCR calculator below to see where your business stands.

If you’re applying for an SBA 7(a) loan, you’ll quickly hear about DSCR (Debt Service Coverage Ratio). This financial metric tells lenders how well your business’s cash flow coverage stacks up against your total debt service.

DSCR = Net Operating Income (NOI) ÷ Total Debt Service

In plain English: For every $1 you owe in loan payments, how many dollars of income do you have available?

A DSCR below 1.0 means your business isn’t generating enough income to cover debts—something SBA lenders consider a red flag.

💡 Pro Tip: For more, check out the SBA’s guide on financial ratios and how they influence lending decisions.

Does the SBA set a required DSCR?

Not directly. SBA provides lending guidelines, but individual banks and approved lenders set their own thresholds. According to SBA’s 7(a) Loan Program overview, lenders must verify repayment ability, which is where DSCR comes in.

Most lenders want to see:

Minimum DSCR of 1.15× (bare minimum for many deals)

Preferred DSCR of 1.20×–1.25× (sweet spot for approvals)

Higher DSCR (1.35×+) often leads to better interest rates and more flexible terms

Formula:

DSCR = Net Operating Income (NOI) ÷ Total Debt Service

Net Operating Income (NOI): Your business’s earnings before interest, taxes, depreciation, and amortization (EBITDA).

Total Debt Service: Annual principal and interest payments on all loans, including the new SBA 7(a) loan.

Example:

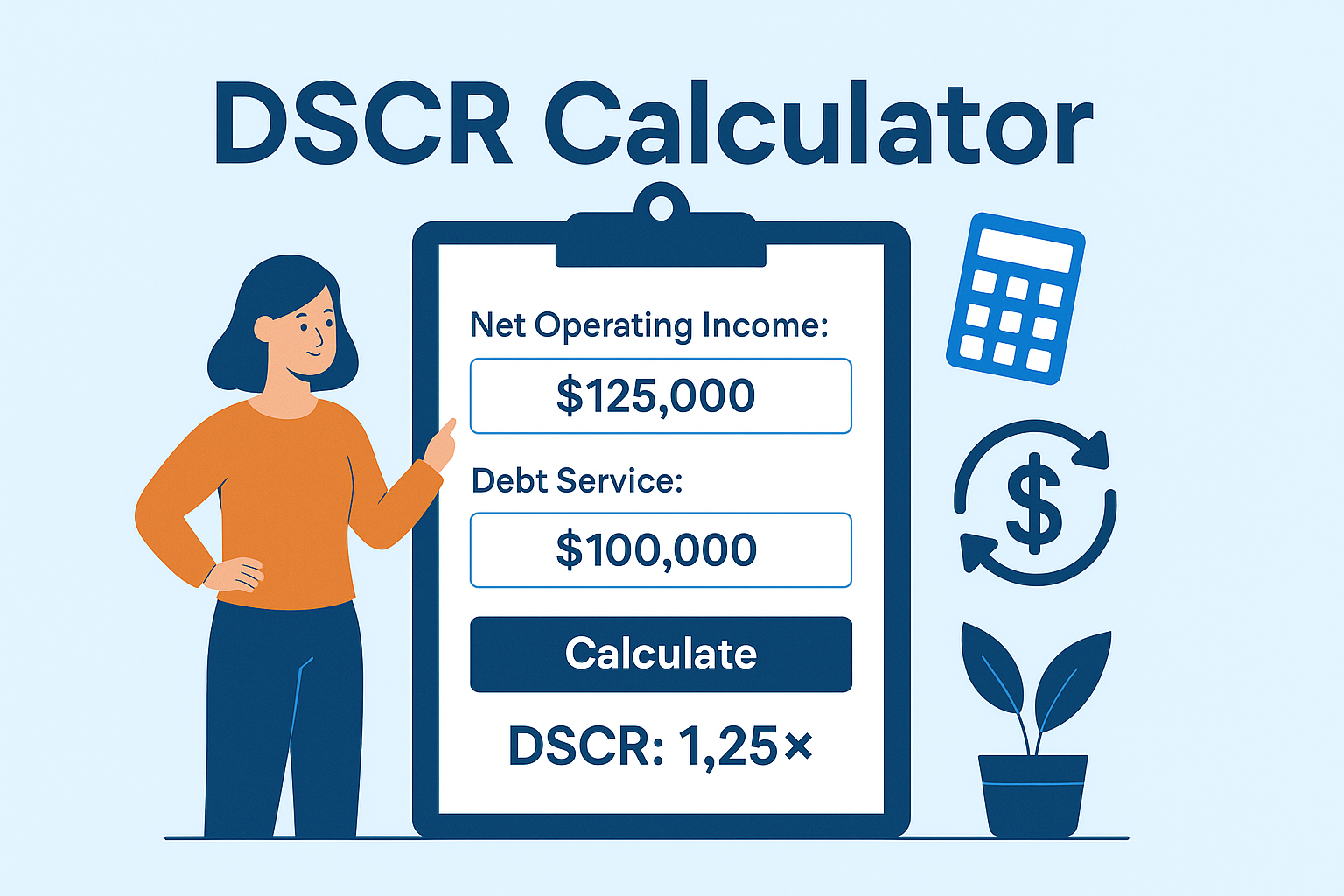

If your NOI is $125,000 and your annual loan payments total $100,000:

DSCR = 125,000 ÷ 100,000 = 1.25×

✅ This meets the typical SBA lender benchmark.

Lenders use DSCR as part of their underwriting standards to determine how risky your loan is. A stronger DSCR means:

Higher loan amounts may be approved.

Lower interest rates could be offered.

More favorable terms such as longer repayment periods.

A weaker DSCR can lead to smaller approved amounts or outright denials—even if your credit score is excellent.

| DSCR | Approval Likelihood | Typical Scenario |

|---|---|---|

| <1.0× | ❌ High risk | Business not covering debt |

| 1.15× | ⚠️ Borderline | May need extra collateral |

| 1.25× | ✅ Standard | Meets most SBA 7(a) lender requirements |

| 1.35×+ | 🌟 Excellent | Better rates & flexibility |

If your DSCR is below lender standards, consider alternate financing like a business line of credit or revenue funding while you improve cash flow.

💡 Pro Tip:Want even more actionable tips to strengthen your cash flow (and in turn, your DSCR)? Investopedia shares a helpful list of 10 ways to improve cash flow that you can start implementing right away.

Your Debt Service Coverage Ratio isn’t just another number—it’s the heartbeat of your SBA 7(a) loan application. When you understand how lenders view DSCR and take steps to improve your net operating income and manage total debt service, you put yourself in the best position to unlock higher approval odds, better rates, and more flexible terms.

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306