Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

When lenders evaluate startups, the word startup alone means very little. What actually matters is whether the business is pre-revenue or post-revenue. That single distinction determines not only approval odds—but whether MCA funding is even appropriate.

A merchant cash advance, often referred to as MCA or MCA loans, is a form of financing based on future receivables rather than fixed loan payments. While most MCA products are not technically business loans, certain states allow business loans to be structured and marketed as an MCA. For that reason, the terms merchant cash advance, MCA, and MCA loans are commonly used interchangeably across the industry.

This guide explains how MCA loans work for startups, who qualifies, real costs, risks, and how funding strategies should evolve as a startup moves from launch to revenue.

MCA loans are not suitable for pre-revenue startups

MCA funding works best for post-revenue startups operating 6+ months

Typical MCA minimums start around $7,500 per month in revenue

Pre-revenue startups rely on credit-based funding, not revenue-based products

Using the wrong funding tool at the wrong stage increases failure risk

MCA loans—more accurately referred to as MCA funding—provide upfront capital in exchange for a portion of future sales. Repayment is automated through daily or weekly ACH debits or card splits and fluctuates based on revenue volume.

Because MCA funding is underwritten on cash flow, not time in business or collateral, it is often grouped into unsecured business funding options. However, unsecured does not mean low risk—especially for young companies.

For startups, MCA loans bypass traditional bank requirements—but only once revenue exists.

Funding eligibility changes dramatically once a startup begins generating sales. MCA funding sits firmly on the post-revenue side of that line.

A pre-revenue startup has not yet produced consistent sales. This typically includes:

Businesses still in development

Companies preparing to launch

Founders operating on projections instead of deposits

Because MCA loans are repaid from actual receivables, pre-revenue startups do not qualify. There is no revenue stream to advance against.

At this stage, funding is credit-driven, not revenue-driven.

One of the most common pre-revenue funding strategies is either a personal loan or credit card stacking.

To qualify for effective credit card stacking or a personal loan, founders generally need:

Excellent personal credit (typically 700+ FICO)

No more than 3 hard inquiries in the last 90 days

Clean payment history with low utilization

Sufficient personal income to support approvals

Credit card stacking allows founders to access startup capital by leveraging multiple personal or business credit cards to fund launch expenses such as inventory, equipment, marketing, or initial operating costs.

This approach carries personal liability and requires disciplined cash-flow management, but it remains a legitimate pre-revenue funding option when MCA funding is structurally incompatible.

Key distinction:

Credit card stacking is startup capital.

MCA funding is growth capital.

For pre-revenue startups, the priority should be aligning capital with traction—not urgency. Founder education resources like the Y Combinator Library consistently stress that early-stage businesses should focus on proving demand, preserving flexibility, and avoiding fixed repayment obligations before revenue exists.

A post-revenue startup has launched and is actively generating income. This is where MCA loans become relevant.

MCA funding is best suited for post-revenue startups that meet baseline underwriting thresholds:

At least 6 months in operation

Minimum $7,500 per month in verifiable revenue

Consistent business bank deposits

Active business checking account

At this stage, lenders underwrite based on cash-flow performance, not business plans or projections. This is why many startups denied traditional financing still qualify for MCA funding.

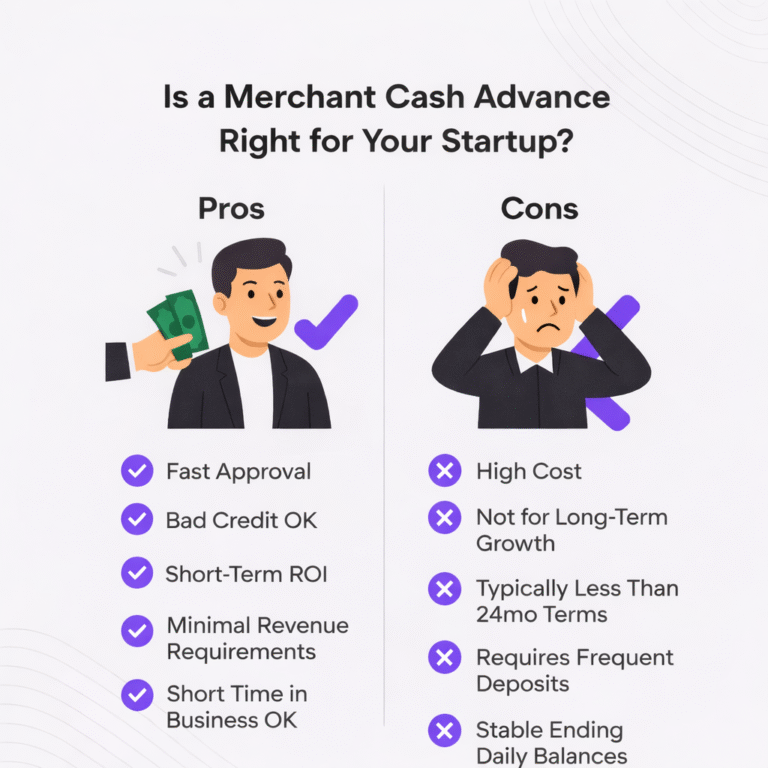

For startups that have proven demand, MCA loans offer:

Fast approvals and funding speed

Minimal documentation requirements

No collateral and typically no personal guarantee

Repayment tied directly to sales volume

This structure can work well for post-revenue startups with uneven or seasonal revenue—particularly those needing short-term working capital for inventory, marketing, or fulfillment gaps.

However, speed and flexibility come at a cost.

MCA loans can be appropriate when:

The startup is clearly post-revenue

Monthly revenue exceeds $7,500

Capital produces near-term ROI

There is a defined payoff or refinance plan

Used correctly, MCA funding can function as short-term growth capital rather than a long-term burden.

If your startup is post-revenue, operating for six months or more, and generating consistent deposits, MCA funding may be an appropriate short-term solution.

At AMP Advance, MCA loan evaluations consider:

Actual cash-flow performance

Revenue trends and consistency

Existing funding exposure

Whether MCA funding makes sense—or if another option is safer

Apply for MCA funding only if your business is past the launch stage and actively generating revenue.

Pre-revenue startups are better served by credit-based strategies until sales are established.

Yes, startups can qualify for MCA loans, but only if they are post-revenue. Most MCA funding providers require at least six months in operation and $7,500 or more in monthly revenue. Pre-revenue startups do not qualify because MCA funding is based on future receivables, not projections.

MCA funding for startups typically requires consistent business bank deposits, verifiable monthly revenue, an active business checking account, and a minimum operating history of six months. Credit score is usually less important than cash-flow performance, which is why MCA loans are often used as unsecured working capital

Funders use bank statements to analyze true deposits, negative days, overdrafts, NSF events, and whether the business can support daily or weekly remittances without cash flow strain.

As well, all banks are not created equal, Fintech banks often conflict with ACH debits with Merchant Cash Advances, many funders will automatically declines these accounts. Rule of thumb is stick to brick and mortar banks.

Pre-revenue startups should focus on credit-based funding, such as credit card stacking, rather than MCA loans. This approach typically requires a 700+ FICO score, limited recent credit inquiries, and strong personal credit history. MCA funding becomes appropriate only after consistent revenue is established.

MCA loans for startups are stage-specific financing. Pre-revenue startups should focus on credit-based strategies like credit card stacking, provided they have excellent credit and minimal recent inquiries. Post-revenue startups operating for six months or more can use MCA funding tactically—but only with discipline, cash-flow awareness, and a defined exit plan.

Right capital, right stage, right outcome.

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306