Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Phone:

(844) 462-4730

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Learn how to prepare your business for funding with a pre-checklist

Understand what real MCA offers look like (and what’s a trap)

Avoid bait tactics like the “carrot scheme” promising fake term loans

Verify merchant cash advance companies through reviews and presence

Create a post-funding game plan that supports growth, not depende

When cash flow gets tight or growth opportunities pop up, merchant cash advance companies can help you move fast. But fast funding shouldn’t mean blind decisions. In this guide, we’ll walk through a professional borrower’s lens—how to prepare, what to watch for, and how to make the most of your funding experience with legitimate partners like AMP Advance. If you’re searching for the best merchant cash advance companies or comparing merchant cash advance companies near me, this guide will help you separate facts from fiction.

For a deeper dive into how merchant cash advances work—including factor rates, payback structures, and renewal options—check out our Merchant Cash Advance guide.

Seasonal demand or slow receivables

Quick inventory or equipment needs

Low credit score or time-sensitive opportunity

Traditional banks said no or take too long

These are common reasons, but let’s take a look at how this plays out in real life.

Angela runs a mid-sized restaurant in Boston. Every December, her business spikes by 40% due to holiday parties and catering requests. To meet demand, she needs to bulk order ingredients, bring on seasonal staff, and repair an aging walk-in fridge. A merchant cash advance provided $35,000 within 48 hours. With the extra capital, she grew seasonal revenue by 50%—easily covering the cost of the advance.

Marcus operates a streetwear boutique in Atlanta and secured a space at a three-month holiday pop-up market. Traditional lenders wouldn’t touch such a short-term lease, but a MCA gave him $15,000 to build inventory and signage. He made $60,000 in sales over the quarter. The MCA, while more expensive than a bank loan, let him capitalize on an opportunity banks wouldn’t fund.

Jose owns an auto repair business in Phoenix. While business is steady, some clients take weeks to pay. Meanwhile, parts need to be restocked, rent is due, and payroll can’t wait. A $20,000 MCA helped bridge that gap. He used it strategically, only when cash flow was tight, and paid it off early with a slight prepayment discount.

Seasonal demand or slow receivables

Quick inventory or equipment needs

Low credit score or time-sensitive opportunity

Traditional banks said no or take too long

💡 Pro Tip: MCAs aren’t debt—they’re sales of future receivables. If your margins are healthy and the use case is revenue-generating, an MCA can be a smart short-term tool.

Explore industries AMP Advance specializes in to see if an MCA is the right fit for your business.

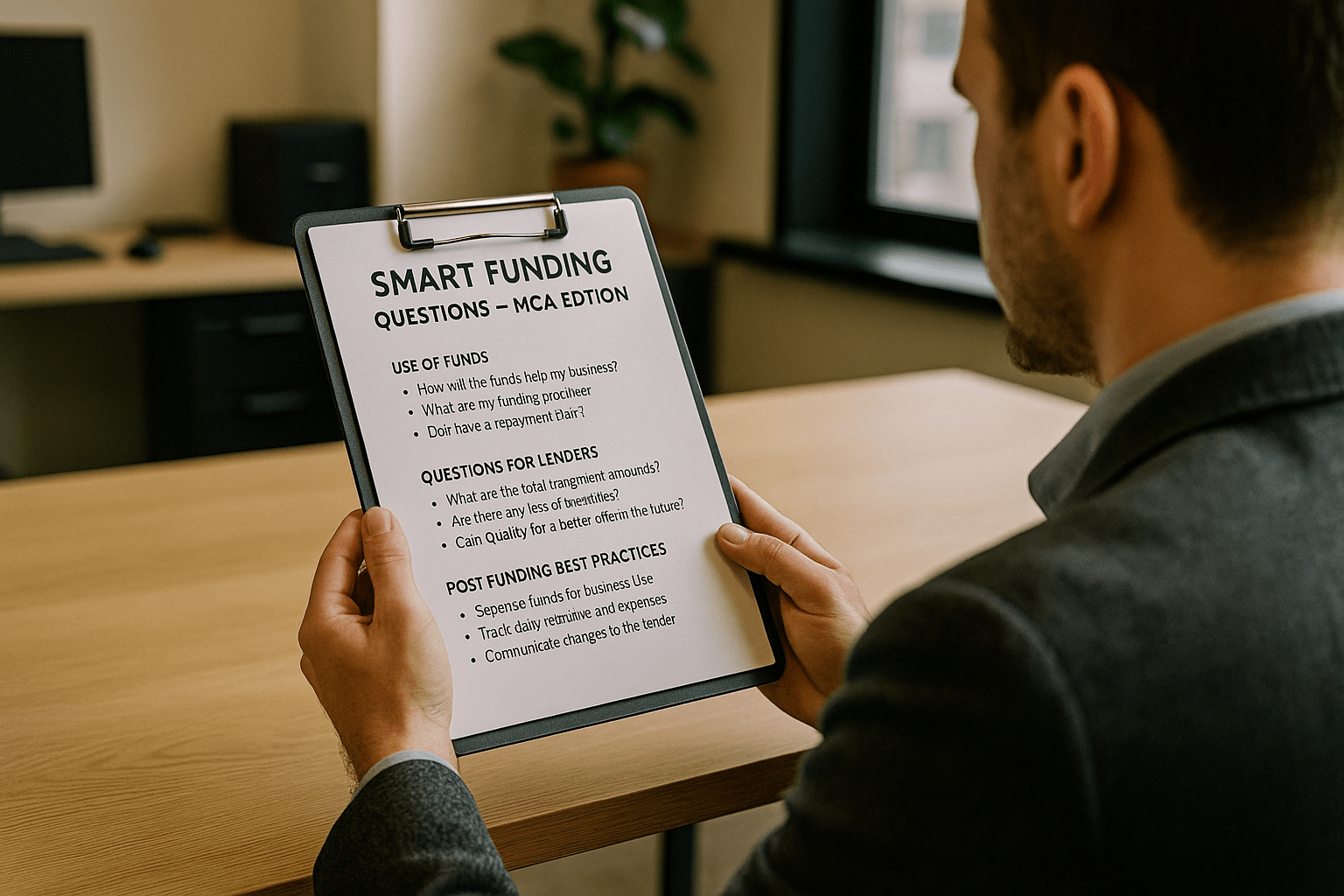

Last 3–6 months of bank statements

Monthly gross revenue and expenses

EIN letter and proof of ownership

Voided business check

What’s the total payback amount, including fees?

What are the daily/weekly payments?

Is there a prepayment option or penalty?

Are you a direct funder or a broker?

Do you offer renewals? How is the prior balance treated?

Will it be rolled into the new advance?

Will a new factor rate apply to the combined amount?

💡 Pro Tip: Ask how renewals are structured. Some funders reapply a factor rate to the remaining balance—doubling your cost.

You can also visit the Consumer Financial Protection Bureau for more insights on small business lending protections.

Here’s a quick breakdown of the pros and cons of working with a direct funder versus a broker:

| Feature | Direct Funder | Broker (ISO) |

|---|---|---|

| Product Variety | Limited to in-house offers | Multiple funding products from various providers |

| Approval Odds | One lender decision | Multiple lender options = higher approval chances |

| Speed | Fast, especially if approved | May take longer depending on submissions |

| Transparency | Clear, but only their product | Depends on broker integrity |

| Fees | Potentially lower (no middleman) | Broker fees may apply |

| Renewal Flexibility | May be rigid | Can shop for better renewal deals |

| Advisory Support | Minimal – only sells one offer | Can guide on best fit and alternatives |

Not all merchant cash advance companies are built the same. Some fund directly, others act as intermediaries.

Direct Funders offer one in-house product. If approved, funding can be quick—but if you’re declined, you’re back to square one. And their offer might not fit your needs.

Brokers (ISOs) work with multiple funders. They can shop your deal across lenders, compare rates, and offer multiple products (MCAs, lines of credit, equipment financing, etc.).

AMP Advance is a trusted partner with verified Google reviews, a clean business profile, and access to multiple funding partners—so you don’t have to shop around or risk working with unethical brokers. As a merchant cash advance company that acts in your best interest, we guide you through the options that actually fit your needs.

💡 Pro Tip: Brokers aren’t bad—bad brokers are. Ask how many lenders they work with and if they offer more than just MCAs.

One of the oldest tricks in the MCA space is the “carrot scheme”—you’re offered a very short-term, high-cost MCA to “prove payment history,” with the promise of a low-interest term loan or line of credit later.

That “next step” rarely exists.

In April 2025, the FBI charged eight individuals with a multi-million-dollar scheme targeting small business owners this way.

For a broader understanding of how merchant cash advances are (and aren’t) regulated, check out this SoFi guide on MCA regulations, which outlines what protections currently exist for small business borrowers.

💡 Pro Tip: Real funders don’t promise term loans after a 30-day cash advance with a 1.70 factor rate. Get all promises in writing.

Getting a merchant cash advance is surprisingly fast compared to traditional lending, but there are still a few important steps to understand.

You’ll typically fill out a short application online or over the phone. You’ll need to provide your business name, industry, average monthly revenue, and time in business. Reputable companies like AMP Advance may also request your EIN, business license, and last 3–6 months of bank statements.

Unlike traditional banks that take weeks to decide, MCA underwriters review your daily or weekly cash flow patterns. This process can take anywhere from a few hours to one business day. If approved, you’ll receive an offer via email or even text message. The offer will include:

The funded amount (e.g., $40,000)

The total payback (e.g., $54,000 based on a 1.35 factor rate)

Payment schedule (e.g., $450 daily Monday–Friday)

Once you accept the terms, you’ll sign a digital contract. Be sure to read it carefully, especially the repayment terms, prepayment clauses, and renewal options.

After signing, funds are typically deposited via ACH transfer to your business account within 24–72 hours. Some funders can even provide same-day deposits for urgent needs.

Repayments start automatically, usually the next business day. Be sure your account has enough cash flow to support the schedule without triggering overdrafts.

Explore AMP’s merchant cash advance process to see how fast funding can work for your business.

Approval often comes by email or text—not a formal term sheet

Offers include factor rate, total payback, and daily/weekly payments

You sign digitally; funds arrive in 24–72 hours

💡 Pro Tip: Always request a copy of the signed agreement and keep all communications in writing. Verbal terms aren’t enforceable.

Use funds for inventory, marketing, or contracts with measurable return

Communicate early if sales dip

Track repayment vs. revenue to stay cash flow positive

Track your daily/weekly debits

Maintain a cushion in your operating account

Avoid unnecessary renewals unless it truly improves your position

Time pressure can make a merchant cash advance feel like a lifeline—but that doesn’t mean you should rush. Many businesses accept the first offer they receive without comparing alternatives, resulting in higher payback costs, stricter terms, or limited flexibility. Take the extra day to explore your options.

Some brokers submit your file to multiple funders without your consent. This practice—often called “shotgunning”—can hurt your business reputation and lead to aggressive follow-up calls from companies you’ve never spoken with. Always ask who will see your application and how your information will be used.

Be cautious of anyone promising a long-term loan or line of credit once you “prove yourself” through an MCA. This carrot-dangling tactic is rarely backed by actual approval criteria or documentation. Unless you have a written offer for that future funding, assume it’s just sales talk.

Many business owners assume renewals are a financial upgrade, but that’s not always the case. If your current balance is rolled into a new advance with a fresh factor rate, you could be paying interest on top of interest. Always ask for a breakdown of how a renewal will impact your cost of capital and total payback.

A company that provides funding based on future receivables, often used by small businesses who need fast working capital.

Yes—if you work with transparent, reputable providers who clearly disclose terms and don’t pressure you.

We’re a broker with access to multiple lenders and products—giving you choices, not sales pressure.

Yes. Most MCA decisions are based on cash flow, not credit scores.

A new advance used to pay off the current one. Be sure to ask how the remaining balance is handled and if a new factor rate will apply to it.

The best merchant cash advance companies are transparent, responsive, and realistic. Whether it’s a direct funder or a broker like AMP Advance, your success depends on choosing partners who act in your best interest.

With the right prep and awareness, an MCA doesn’t just solve short-term cash flow issues—it powers smart, sustainable growth.

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306