Phone:

(888) 201-2860

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

Phone:

(888) 201-2860

Business Hours

Mon-Fri: 9AM - 6PM

Address

97 Newkirk Street, 3rd Floor

Jersey City, NJ 07306

[ez-toc]

Securing an unsecured business loan with bad credit can be challenging as traditional lenders often view a poor credit history as a red flag, indicating a higher risk of default. However, obtaining an unsecured business loan is not impossible even with less-than-stellar credit. By understanding the requirements, exploring alternative lending options, and improving other aspects of your financial profile, you can increase your chances of approval. This article will explore various strategies and tips to help you qualify for an unsecured business loan despite a low credit score.

An unsecured business loan is a type of financing that does not require collateral. Unlike secured loans, which are backed by assets such as real estate or equipment, unsecured loans rely on the borrower’s creditworthiness and financial stability.

This lack of collateral means higher risk for lenders, often resulting in stricter qualification criteria and higher interest rates

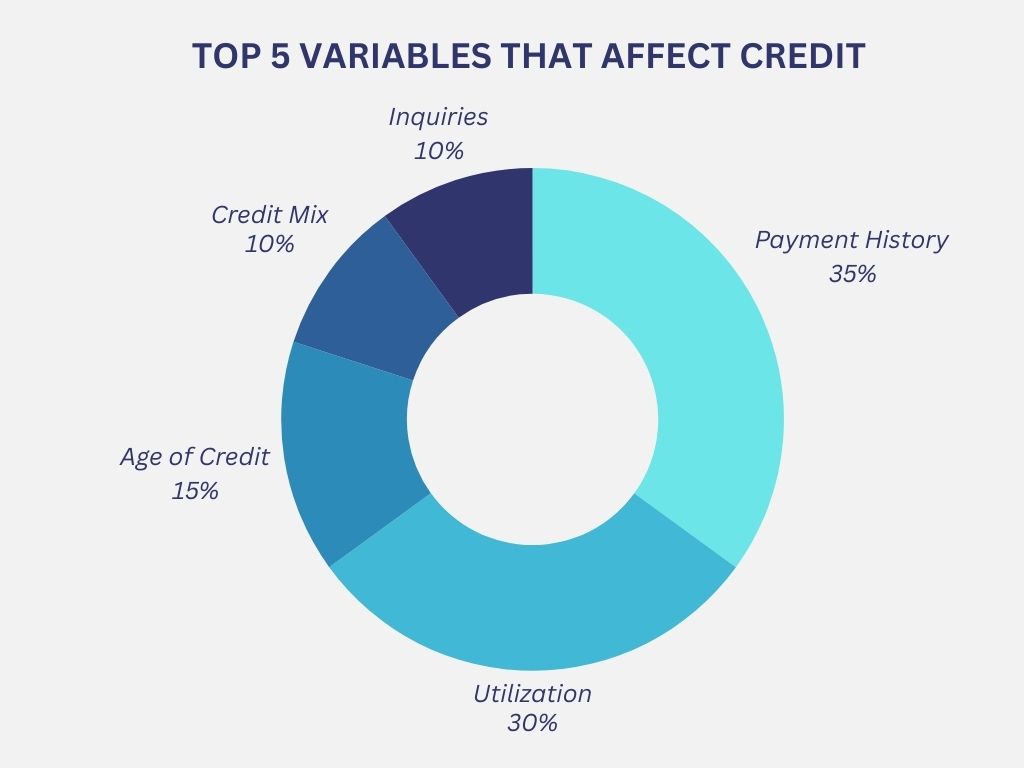

Credit scores are numerical representations of your creditworthiness based on your credit history. A low credit score typically indicates past financial mismanagement, such as late payments, defaults, or high levels of debt. Lenders use credit scores to assess the risk of lending money to a borrower. A low score can make it difficult to qualify for an unsecured business loan, as lenders may perceive you as a high-risk applicant.

While a low credit score can be a significant hurdle, it is not an insurmountable one. Here are several strategies to improve your chances of qualifying for an unsecured business loan

Lenders are more likely to approve a loan if you can show consistent and healthy cash flow. Provide detailed financial statements, including profit and loss statements, balance sheets, and cash flow projections. Highlight any periods of increased revenue or profitability, as this can help reassure lenders of your ability to repay the loan.

Building business credit improves your chances of securing an unsecured business loan. Steps include incorporating your business, obtaining an EIN, opening a business bank account, registering with credit bureaus, establishing trade lines, and using business credit cards responsibly. These actions can strengthen your business credit profile and offset a low personal credit scores.

Traditional banks are not the only source of unsecured business loans. Alternative lenders, such as online lenders, peer-to-peer lending platforms, and microlenders, often have more flexible criteria and are willing to work with borrowers with lower credit scores. Research and compare different lending options to find one that aligns with your needs and qualifications.

A co-signer or guarantor with a strong credit history can significantly improve your chances of securing an unsecured business loan. This individual agrees to take on the responsibility of repaying the loan if you default. Lenders view this as a reduced risk, making them more likely to approve your application.

Although you are seeking an unsecured loan, offering collateral as a back-up option can sometimes sway lenders in your favor. This collateral does not necessarily have to be used, but its availability as a safety net can provide additional assurance to the lender.

If you are unable to secure an unsecured business loan with favorable terms, consider negotiating with the lender. You may be able to agree on a higher interest rate, shorter repayment term, or other concessions that make the loan more acceptable to the lender despite your low credit score.

Credit unions and local large banks often have more personalized lending criteria and are more willing to work with small business owners. These institutions may be more understanding of your situation and willing to provide an unsecured business loan despite a low credit score.

To increase your chances of approval, it is essential to prepare a thorough and compelling loan application. Here are some key components to include:

While it is possible to obtain an unsecured business loan with a low credit score, improving your credit score can significantly enhance your chances and open up more favorable lending options.

Here are some steps to help improve your credit score:

Qualifying for an unsecured business loan with a low credit score is challenging, but not impossible. By demonstrating strong cash flow, building business credit, seeking alternative lenders, and considering a co-signer or guarantor, you can improve your chances of approval.

Additionally, negotiating better terms, showcasing your industry experience, and utilizing credit unions and community banks can further increase your chances. Preparing a thorough loan application and taking steps to improve your credit score will also enhance your prospects. With determination and strategic planning, you can secure the financing you need to grow and succeed in your business.

Yes, it is possible to get an unsecured business loan with a low credit score by demonstrating strong cash flow, building business credit, seeking alternative lenders, and potentially having a co-signer or guarantor.

To improve your chances, you can focus on demonstrating strong cash flow, building business credit, seeking alternative lenders, providing collateral as a back-up option, and having a co-signer or guarantor.

Building business credit can mitigate bad personal credit by showing good payment history on credit lines with vendors you work with.

Alternative lenders include online lenders, peer-to-peer lending platforms and credit unions or microlenders, which often have more flexible criteria and are willing to work with borrowers who have lower credit scores.

AMP Advance provides unsecured business loans for bad credit, tailored to meet your immediate financial needs. Our streamlined application process ensures hassle-free access to multiple funding options without a hard credit pull. Take the first step towards business success and apply with AMP Advance today!

©2025 All Rights Reserved.

By clicking “Submit”, you (i) consent to receiving calls and texts, from AMP ADVANCE Business Loans and those acting on its behalf at the telephone number you have provided above (including your cellular phone number); consent to receiving telemarketing calls or texts at this number using an automatic telephone dialing system by, or on behalf of, AMP Advance or its affiliates; agree that this consent applies even if the number you have provided is currently on any state, federal, or corporate Do-Not-Call registry; and understand that you are not required to provide this consent as a condition of receiving any credit or services from AMP ADVANCE and that you may apply for business credit by contacting us directly; and (ii) acknowledge that you have read AMP ADVANCE Terms & Conditions , Privacy Policy and SMS Wireless Policy. You understand that you may opt-out of receiving communications of your choice from AMP ADVANCE as provided in the Privacy Policy and SMS Wireless Policy.